What’s the big deal with collectibles? Well, they sometimes make a great investment.

Around here, “collectibles” can mean almost anything. Things just seem to collect, as I wrote about in Huffington Post. Some is on purpose. For instance, all the snow globes my older daughter collects. And the theatre programs. And the books. And the DVDs (possibly the world’s largest collection!).

All these collectibles share a few things in common:

- They collect a lot of dust, making them both collectibles and collectors.

- Most are rarely used in any way.

- They have reduced our net worth by a few billion dollars. But that’s OK, because some day we can sell them.

- Those that we can someday sell might fetch us a total of $250, but maybe I’m dreaming.

What gets under my skin, is that some people actually increase their net worth with collectibles. The uncertainty of many traditional investments has made collectibles a credible and sometimes profitable venture.

What are collectibles?

- Art, such as painting and sculptures

- Antiques

- Jewels

- Historical documents and artifacts

- Pop culture stuff (like special edition Barbie dolls, still in the package)

What’s really cool about these things is that they are real. You can see them. You can touch them. They have history. They are more than just a note saying that somewhere you have some value stored. They are more than just bits and bytes on a computer.

As investments, these items have an intrinsic value that money itself doesn’t even have. That’s why they are more likely to hold their value for the long term.

Before getting too excited and jumping in with both feet, best to start slowly and show some self control. Remember that this is an investment. Just as with stocks and bonds, you need a plan, you need a strategy and you have to learn as you go. If you sink too much money into any investment up front, you won’t have the money you need for day to day expenses.

You will have to commit your money for the long term. That’s how any investment works. Remember the difference between lotteries and investments?

- Lotteries eat your money bit by bit, eroding it over the years. Then – Bang! – a sudden huge payoff for a few lucky people.

- Investments take a big infusion at the beginning, then the value grows slowly over the years.

- Unlike the lottery, an investment will yield good dividends for you, but you must be able to live without the cash you put in during that time.

Here are some strategies to do collectibles investing right.

Work Your Way Up In Value

As with any investment, the key to success is to buy low and sell high. Repeat after me. Buy low. Sell high. But that is easier said than done. One never knows how high an item’s value will go. And there is always the possibility that it will go down. What you can control is your buy price. If your initial investment is low, your odds of a profit are good.

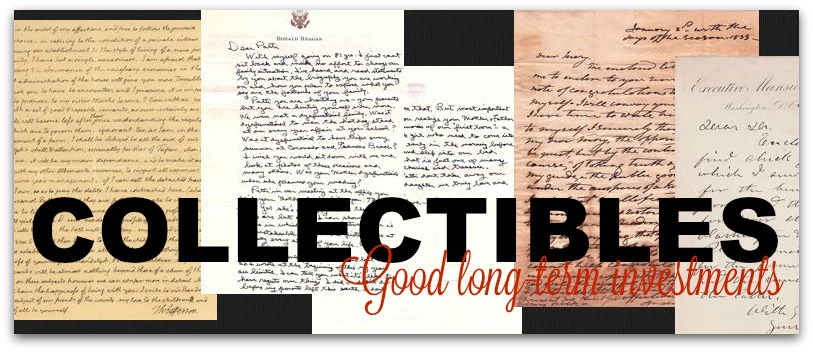

Historical documents are a great example of something that is unlikely to decrease in value. It is also a way to start small, learn the ropes and build up a strong portfolio over time.

You can start with items of local appeal–newly signed state or provincial laws, campaign items, and so forth. As they increase in value, you can re-sell them to buy items with a greater geographic appeal. When you’ve become a skilled investor, you can work your way up to items of international renown. Those are the ones likely to hold their value the longest. They will keep increasing in value, because the names are historical figures:

- Ronald Reagan.

- Elvis Presley.

- Michael Jackson.

- John Diefenbaker

- Andrew Jackson.

- Margaret Thatcher.

Yes, you can actually own documents belonging to famous people like this. You can see some examples at the Raab Collection.

For the buy low part of the equation, you can explore opportunities to get items that don’t at first blush appear valuable. Pick ones that will later surge in value due to unexpected events.

The death of a prominent person creates an immediate surge in the value of anything they related to them. Consider how memorabilia related to David Bowie or Nancy Reagan has surged in value since those recent deaths. Especially valuable are the final items they produced. For instance, Justice Scalia’s last opinion or Helen Thomas’ notes from her final press conference.

Of course, it doesn’t take a death to increase value. Any music recorded in LP form – on actual vinyl – likely hit a peak value in the last few years before the medium made a recent resurgence.

Track Values

It can be tough to decide when to sell an item. If you want to maximize short-term profit, it’s best to sell while the value is still increasing. Get buyers into a bidding war while the selling is easy. Then hop on the next low priced item.

If you can’t sell on the upturn, because the price of your item is already dipping, sell fast! Don’t wait to try to get “the best price”, because the best price will get lower each day.

Baseball cards took a plunge in the 1980’s, when the market was flooded with new companies. The 1994 strike season further eroded values. Since then, individual cards have rebounded. If you were trying to build value in the 1980’s, good luck. It would have been best to sell before the 1980,s, second best to sell in the early 1980’s.

The take-home message is this: be mindful of how events change value, and be prepared to sell at top dollar.

Protect Investments

Security for collectibles is different than for stocks and bonds. I used to collect stamps. Now there is something that has lost value! Only a few of the rarest stamps continue to increase in value. You have to focus on what is rare. And I can tell you that I did not just toss my stamps into a box and wait for the value to rise. Extras of common stamps, sure. But anything on the rare side would be stored carefully:

- Special albums, made of the right paper.

- Never in the basement, where there could be too much humidity.

- Spaced out to avoid damaging the perforations.

- Out of the sun, to protect the colors.

And I was just collecting them for fun, not for profit. I never owned any truly rare specimens.

For investors, it doesn’t end once the stamps are safely ensconced in an album. Collections with a high cash value are also stored under lock and key. This can be challenging for items that you want to enjoy with family and friends. Bank managers tend to object when you bring the family reunion to the safety deposit box at the bank. But you can at least install a burglar alarm in your home. And you can take steps to protect them from harm.

That is why Barbie Dolls and G.I. Joes still in their packages keep increasing in value. And why outside their packages, they hold almost no value.

Avoiding theft, water damage, fading, nicks and dents, and other perils is key to maximizing value. The difference in just one downward step in condition can be substantial. Invest some of your money in keeping your items in the high-dollar bracket.

Using collectibles as an investment can be effective if you take it seriously. You don’t have to worry about the complexities of the stock market, insane collapses like the 2008 subprime crisis, or the threat of bogus stocks. You will have an item that cannot be duplicated, and it will always have value. You can see it and touch it. You know it’s real, and there is a pride of ownership that stocks and bonds will never give you.